It’s not what you make. It’s what you keep. That is true for all of us, but retirees who are no longer working don’t likely have a way to make more money to keep. So they need help to control what they can. Once they’ve made the wrong choice on the timing of withdrawing income, it’s often too late to do anything about it. I talk about this all the time in employee education programs. There are so many retirement planning strategies that have helped many build up plenty of assets, but need some tweaks to the timing of withdrawals or starting income types to maximize how much a client will keep.

Timing is everything

As a regular part of the retirement planning discussion, be sure to help your clients understand how much control they have over the timing of various retirement resources. For clients with pensions, what happens to that benefit if they delay it and take more income from their RRIF for a few years? What if they put off their CPP or OAS? How much higher will their guaranteed retirement income be if they use another taxable, but non-guaranteed income source at first? Many can keep more if they control the timing of withdrawals, or of triggering regular payments of fully taxable retirement income.

You can get ahead of it

Clients that are very close to retirement can’t go back in time and fill up their TFSA, and capture the up to 14 years these accounts could’ve been growing since they launched. But for those clients who still have some time to go before they get close to winding down their working lives, they could create a lot of tax-free income in retirement if they are aware of it now. One of the best things clients can do is maximize their TFSA contributions as soon as possible. Only 8.9% of TFSA account holders have maxed out their contributions. Too often these accounts are only maximized after RRSPs are tapped out. But while RRSPs contributions will create some tax savings during our working lives, RRSPs are 100% taxable income upon withdrawal. I’m still very concerned at the sheer number of people we educate who don’t realize this. We still see far too many people assuming that if they wait to take funds out of their RRSP until it’s a RRIF, or until they are a certain age, that some of the withdrawals aren’t taxable. Building up a strong TFSA balance can create a tax-free layer of income, and give clients more options when it comes to the timing of other withdrawals.

Using the retirement cash flow planning process to determine a more accurate retirement income need can also help you, so you can help your clients figure out where their retirement savings need to go in order to give them the net income they’ll likely need.

Thank you for reading.

Here’s to meaningful financial change. 🙌

|

|

|

|

|

|

|

For professionals:

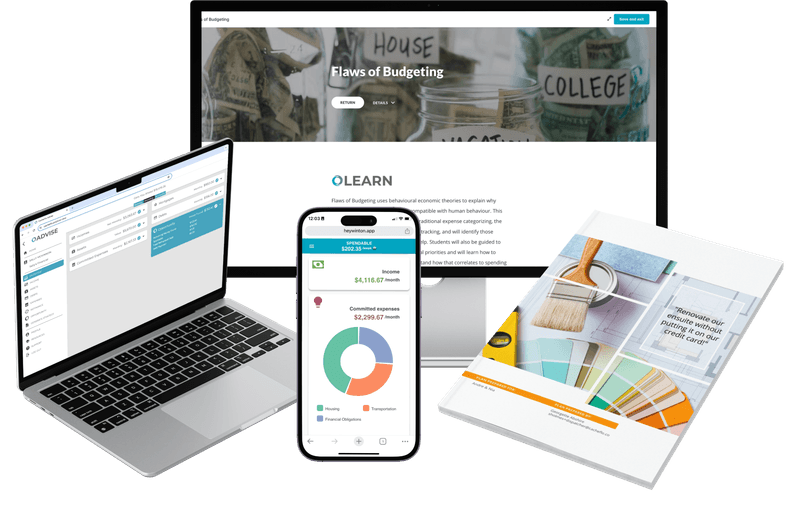

Advisor Unlimited - Be dependable with your spendable

|

|

|

|

Logically, a budget should work, but it’s not practical. Finance is so mathematical and so logical. That’s fine in a vacuum where real humans aren’t doing anything. Budgeting would work well if everybody was a calculator, but they’re

not.

Keep reading in Advisor Unlimited>

|

|

|

|

|

For clients:

Emergency funds can help you keep peace of mind

|

|

|

|

Life can be uncertain. Whether it’s a job loss, major repair on your home or car, family emergency, or natural disaster, all of these could strain your finances – sometimes at the worst possible time. That’s why it’s important to

have an emergency fund that you can fall back on.

Keep reading >

|

|

|

|

|

🚨 NEW Webinar 🚨

How to generate more revenue from advice

And reduce your administrative headaches at the same time

The financial industry is shifting. Clients are demanding fee transparency, embedded commissions are going by the wayside, and lower cost options are on the market everyday.

The mutual fund industry is also under growing scrutiny of how fees are calculated and charged, and how financial professionals earn their income. This leads to more compliance work piling on to the average advisor. The writing is on the wall, and smart financial professionals who want to grow are looking for ways to create sustainable and profitable opportunities, while still providing great advice and products for their clients.

There’s a new business model on the block, and it could be a win-win for many financial advisors in Canada. The co-management serving model is a game changer that can divide and conquer the complexity, and let the advisor focus on client-facing financial advice and still generate revenue.

Join Stephanie Holmes-Winton (CacheFlo) and Michael van Lierop (New Outlook Wealth) on June 26, 2025 at 1pm ET. Learn how you can generate more revenue from advice, and reduce your administrative headaches at the same time.

|

|

|

|

In this session we will:

✅ Evaluate the fee-for-advice model

✅ Discuss hybrid revenue options

✅ Share how you could work closely with portfolio managers

✅ Explore the co-management service model

✅ Learn how to offboard your least favourite tasks

|

|

|

| Sign up here

|

|

|

Retirement Cash Flow Planning Implementation Program for only $249 +tx ($1,200 value)

🚨 On demand now available! 🚨

We hope you’ll join us for a special edition of our 90-day program focused entirely on how to use cash flow planning with clients nearing or in retirement. Register for the Retirement Cash Flow Planning Implementation Program on demand, any time.

This program will include everything the original 90-day program included. We’ll also include some additional retirement resources, and the entire program will be focused on how to use all of the concepts and tools alongside your clients’ retirement plans.

Here’s what you’ll get:

✅ 4.5 hours of live retirement cash flow planning-focused training

✅ 90 days of cash flow planning software, including the client app Winton

✅ CCS Level 1 - Cash Flow Planning Foundations Certificate

✅ Personalized Cash Flow Opportunities Assessment quiz marketing tool

✅ Additional retirement cash flow planning tools

|

|

| Register now

|

We couldn’t say it better than one of our recent participants in this program: “It's a great tool to get leads, help people in a way most advisors aren't, and close higher ticket business that you're able to uncover during the process.”

|

CacheFlo Inc., Halifax, Nova Scotia Canada support@cacheflo.co

|

|

|

|

|

|

|

|